Increase your Credit Card limit instantly

Boost your spending power instantly

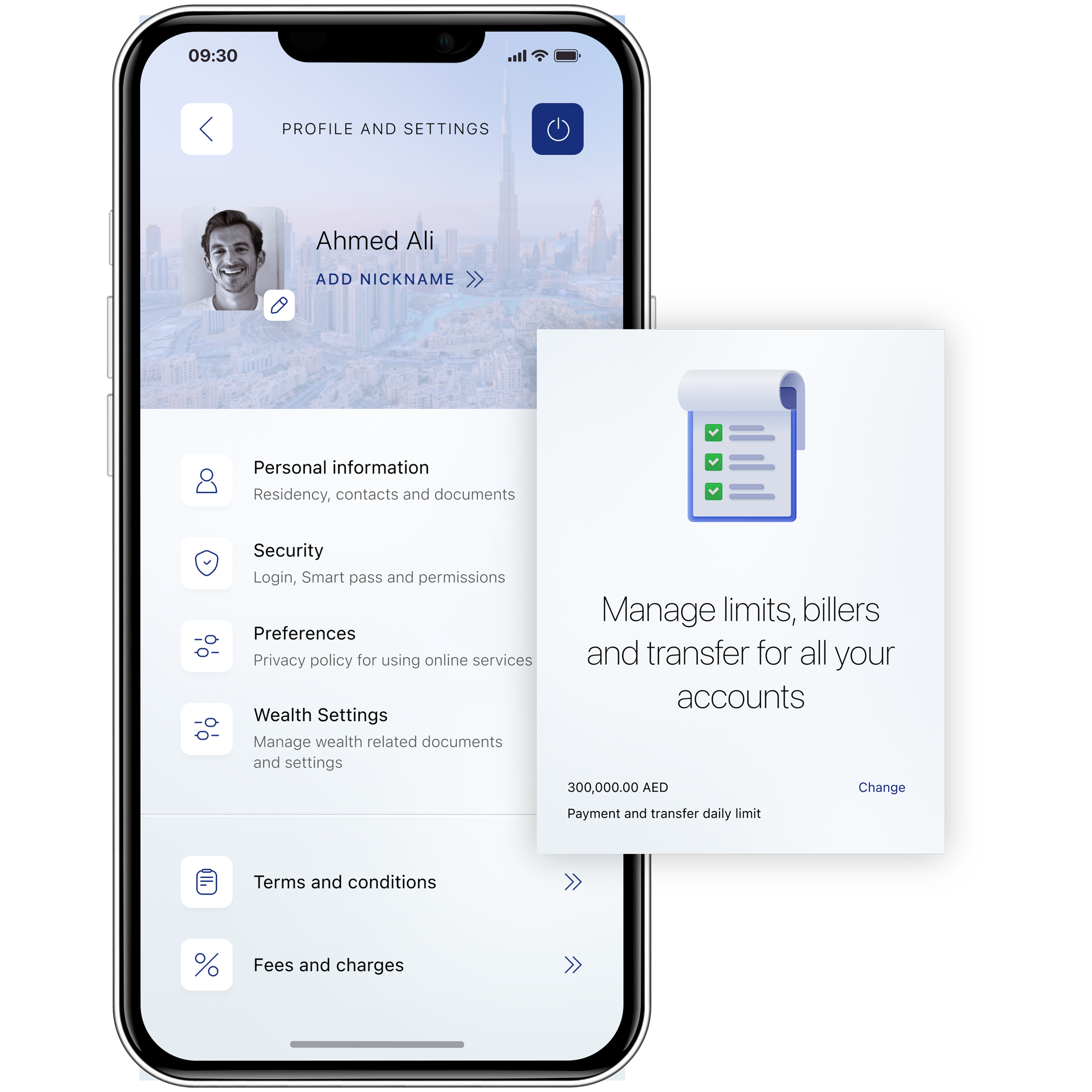

Looking for more financial flexibility? You can now apply for a higher credit limit instantly through ENBD X App.

No documents required

Instant Approval

Quick, Easy & Secure